Unknown Facts About Stonewell Bookkeeping

Wiki Article

The Stonewell Bookkeeping Statements

Table of Contents7 Easy Facts About Stonewell Bookkeeping ShownWhat Does Stonewell Bookkeeping Do?The smart Trick of Stonewell Bookkeeping That Nobody is DiscussingTop Guidelines Of Stonewell BookkeepingRumored Buzz on Stonewell Bookkeeping

Instead of going through a filing closet of various documents, billings, and receipts, you can present detailed documents to your accounting professional. Subsequently, you and your accountant can save time. As an included incentive, you may even be able to recognize prospective tax write-offs. After using your accountancy to submit your tax obligations, the IRS might choose to perform an audit.

That financing can come in the kind of owner's equity, gives, organization loans, and financiers. Yet, capitalists require to have a great concept of your organization before investing. If you do not have accountancy records, investors can not determine the success or failing of your business. They require current, accurate info. And, that information requires to be conveniently available.

Some Ideas on Stonewell Bookkeeping You Need To Know

This is not intended as legal suggestions; for additional information, please go here..

We responded to, "well, in order to know just how much you require to be paying, we need to know just how much you're making. What are your incomes like? What is your take-home pay? Are you in any kind of financial obligation?" There was a lengthy pause. "Well, I have $179,000 in my account, so I guess my web income (incomes less costs) is $18K".

What Does Stonewell Bookkeeping Do?

While it might be that they have $18K in the account (and even that could not be real), your equilibrium in the financial institution does not necessarily identify your revenue. If somebody got a give or a funding, those funds are not considered income. And they would not work into your revenue declaration in identifying your revenues.

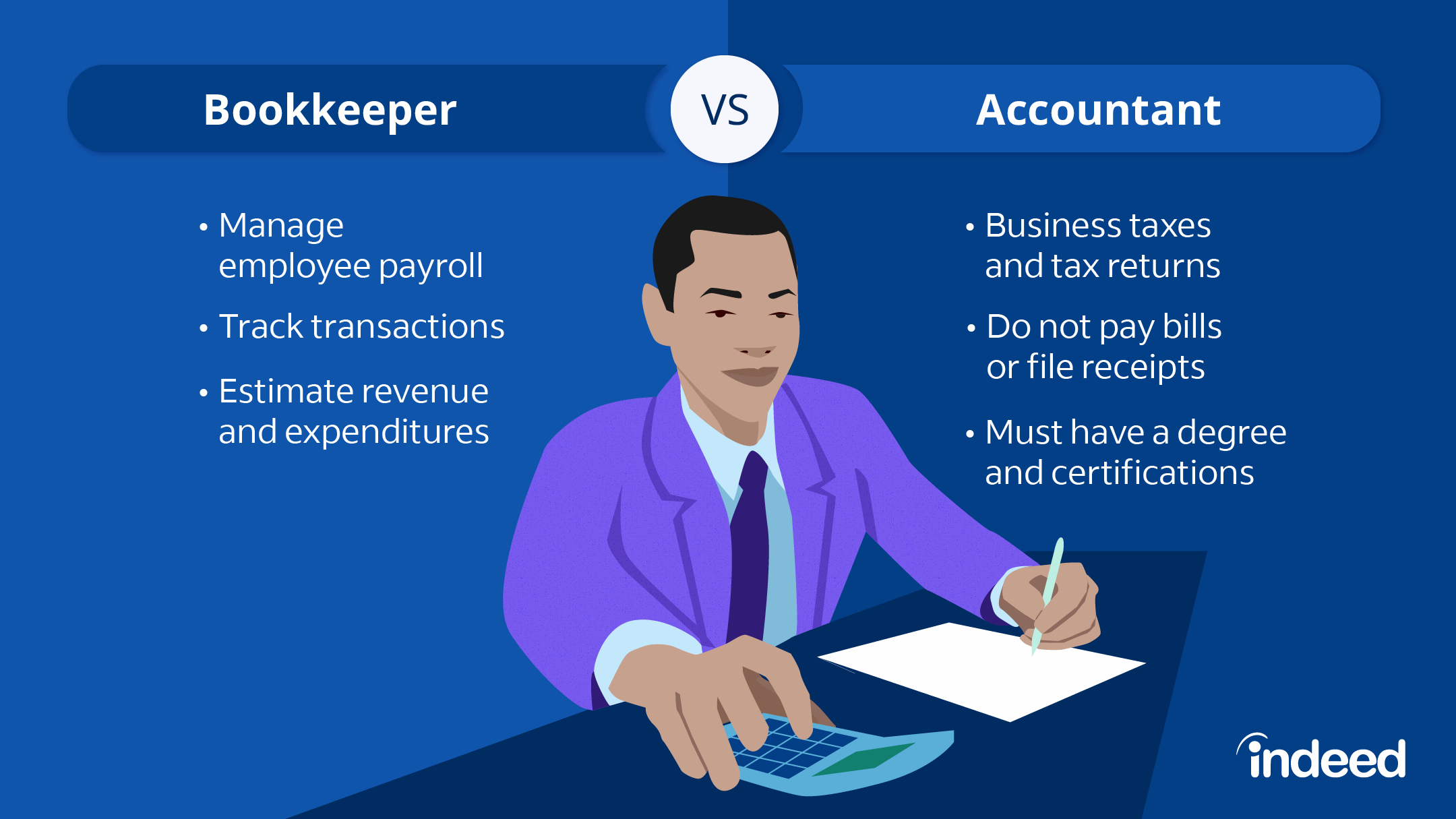

While it might be that they have $18K in the account (and even that could not be real), your equilibrium in the financial institution does not necessarily identify your revenue. If somebody got a give or a funding, those funds are not considered income. And they would not work into your revenue declaration in identifying your revenues.Several points that you believe are costs and reductions remain in fact neither. A proper collection of books, and an outsourced bookkeeper that can effectively identify those transactions, will assist you identify what your service is actually making. Bookkeeping is the procedure of recording, classifying, and organizing a firm's economic transactions and tax obligation filings.

An effective service requires aid from professionals. With realistic goals and an experienced accountant, you can easily address difficulties and keep those worries at bay. We're below to aid. Leichter Accounting Providers is a seasoned certified public accountant firm with an interest for accounting and commitment to our customers - Bookkeeping (https://filesharingtalk.com/members/627904-hirestonewell). We dedicate our power to ensuring you have a solid economic structure for growth.

Excitement About Stonewell Bookkeeping

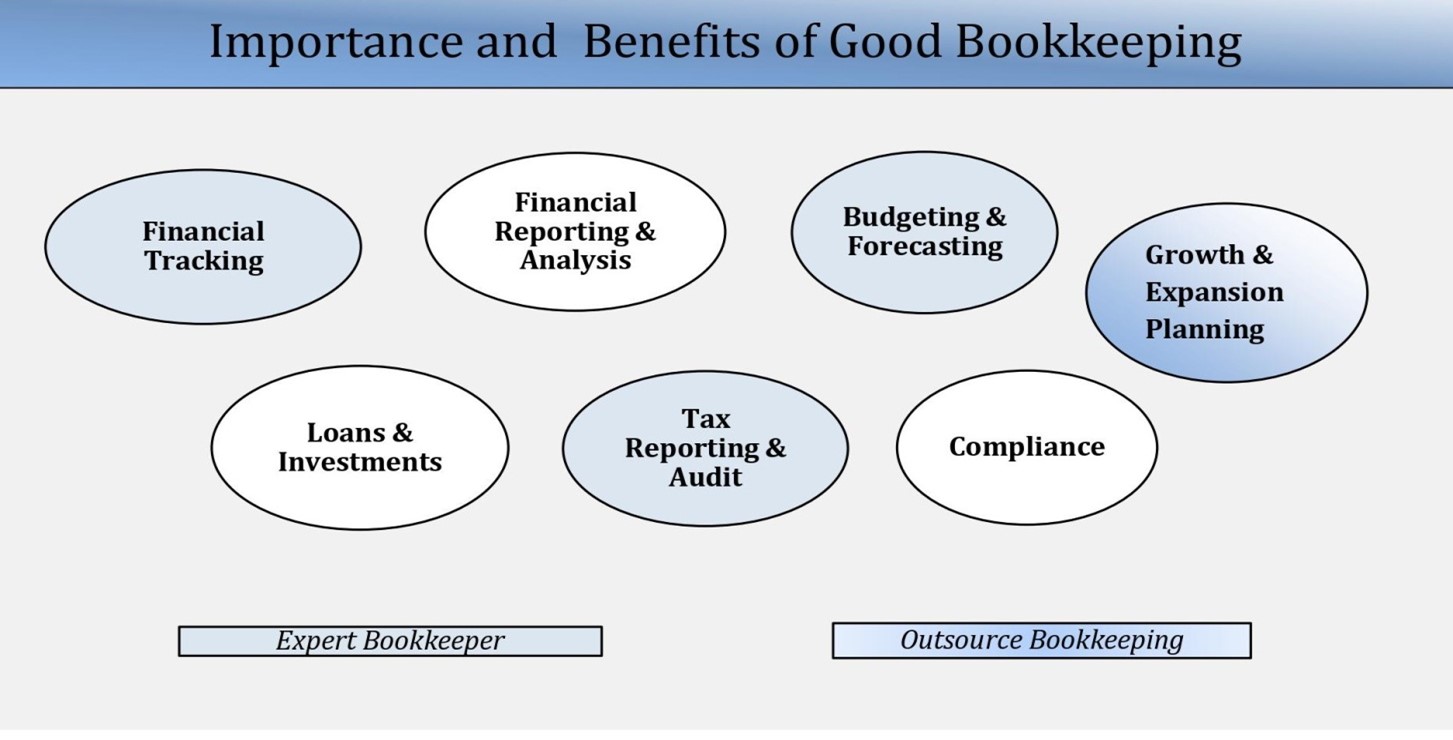

Precise bookkeeping is the foundation of great financial monitoring in any business. With excellent bookkeeping, organizations can make better decisions since clear economic records provide important data that can direct technique and increase revenues.On the other hand, strong accounting makes it simpler to secure funding. Precise economic statements develop count on with lenders and capitalists, enhancing your possibilities of obtaining the capital you require to expand. To maintain strong economic health, organizations ought to consistently reconcile their accounts. This means coordinating transactions with financial institution declarations to catch errors and avoid financial inconsistencies.

They guarantee on-time settlement of expenses and quick customer settlement of invoices. This boosts money circulation and aids to avoid late fines. A bookkeeper will certainly go across financial institution check my blog declarations with inner documents at least once a month to discover errors or variances. Called bank reconciliation, this process guarantees that the financial records of the company suit those of the financial institution.

Cash Money Flow Declarations Tracks cash movement in and out of the organization. These reports assist company proprietors comprehend their economic placement and make notified choices.

What Does Stonewell Bookkeeping Do?

The finest option relies on your budget and company demands. Some small company proprietors prefer to deal with accounting themselves using software. While this is cost-effective, it can be taxing and vulnerable to mistakes. Devices like copyright, Xero, and FreshBooks allow company proprietors to automate accounting tasks. These programs aid with invoicing, financial institution settlement, and monetary reporting.

Report this wiki page